JTB has forecasted that Japanese domestic travelers are expected to increase by 68.4% year on year to 16 million during this coming Golden Week period (April 25 to May 5). Compared to two years ago, the forecasted number is down 43.4%.

JTB package tour bookings were up 30% year on year as of April 5.

The average travel spending a traveler is expected to be up 6.8% to 34,500 JPY (down 3.9% over two years ago). The largest ratio is found in a range from10,000 JPY to 20,000 JPY with 23.8%, followed by a range from 20,000 JPY to 30,000 JPY with 17.8% and less than 10,000 JPY with 14.1%. Total spending is estimated at 552 billion JPY during the period.

According to the sentiment survey by JTB, the ratio of ‘spending less money for travel than before (37.1%)’ outnumbered the ratio of spending more money for travel than before (15.5%)’ amid sharp rise in prices, however the ratio of ‘spending more money’ was higher than a year ago.

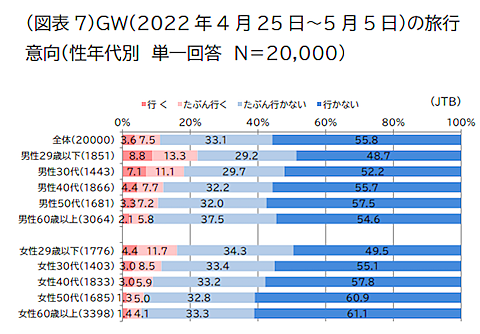

The ratio of travel planners during Golden Week period was 17.2%, 6.9 higher points than a year ago, and higher ratios were especially seen in younger generations: 29 years old or younger males (22.1%) or 29 years old or younger females (16.1%).

報道資料より

報道資料より

On the other hand, the biggest reason for hesitation to travel is still ‘worrying about COVID-19 (39.4%),’ even though the ratio was down 24.5 points compared to a year ago.

One of the noteworthy trends this year is an increase in long-distance travels, unlike the previous trend that travels to neigbour areas were preferred. Also, public transportations, such as airlines or Shinkansen, are more selected than a year ago.

The most selected destination is ‘Kanto’ with 20.7%, followed by ‘Kinki’ with 15.5%, ‘Tokai’ with 10.2% and ‘Kyushu’ with 10.2%. In all regional blocks, the ratio of travelers to the neigbour areas was smaller, which means many people plan to travel far.

The most selected accommodation is ‘hotel’ with 43.8%, 5.6 higher points than a year ago, followed by ‘parent’s or relative’s home’ with 22.3% and ‘ryokan’ with 21.5%. The ratios of ‘camping or outdoor stay (4.5%)’ and ‘vacation rental (1.1%)’ are smaller, though those types of staying increased a year ago.

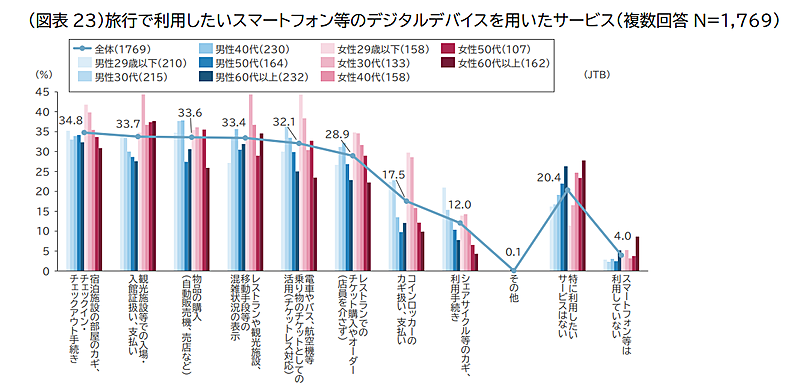

In addition, JTB surveyed what kinds of digital services are desired. The most answers are seen in ‘digital check-in/out or smart key’ with 34.8%, followed by ‘digital payment’ with 33.7%, ‘e-commerce’ with 33.6% and ‘ticketless service for transportation’ with 32.1%.

報道資料より

報道資料より