Key persons of six Japanese major OTAs talked about their results in 2014 and future strategies at WIT Japan 2015. The giant OTAs of Priceline group and Expedia are expanding their businesses globally through their M&A strategies. Under the circumstance, how are they developing the online business?

Panelists were:

Toshiyuki Imai, i.JTB President & CEO

Masabumi Mori, Ikyu President & CEO

Kiyoshi Takano, H.I.S. Executive Office, Senior General Manager, Head of Information Systems Division

Hiroshi Nishida, Yahoo Japan Senior Manager, Travel Dept, Shopping Company

Takanobu Yamamoto, Rakuten Executive Officer, Travel Business

Kenichiro Miyamoto, Recruit Lifestyle Executive Manager

Moderators were:

Kei Shibata, Venture Republic CEO

Yeoh Siew Hoon, WIT Founder

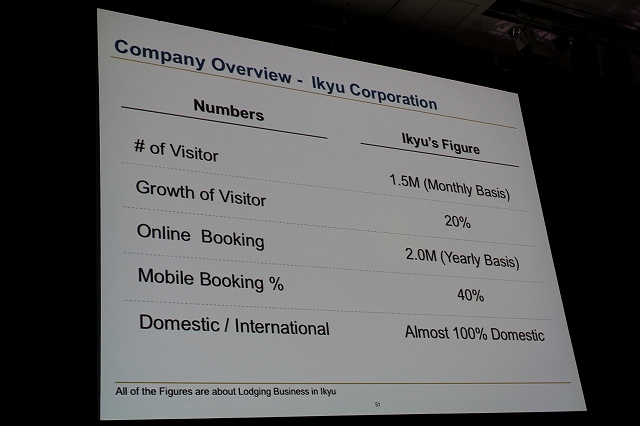

<Ikyu>

One of the business features is that the mobile booking rate has reached 40%, which is higher than 30% of Rakuten Travel and is also a high result in comparison with 44% of the entire e-commerce except travel (FY2014). Mori said, “Ikyu is growing as denominator is increasing,” reporting that growth of visitors reached 20%. Singing exclusive contracts with luxury hotels, Ikyu sold 100 million JPY or more in August only for rooms of Mandarin Oriental Tokyo or 100,000 JPY on an ADR basis for The Ritz-Carlton Kyoto. Ikyu has 4 million potential customers who may book such luxury hotels. “Our strength is to develop both accommodation and restaurant booking sites. We are extending the strength,” Mori said.

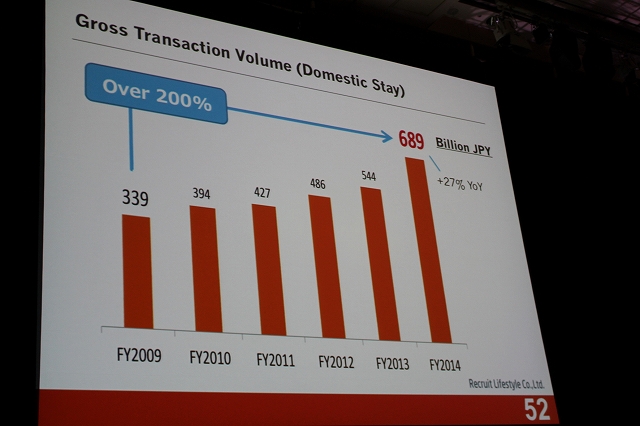

<Recruit jalan>

Recruit Lifestyle, managing travel booking site jalan, increased gross transaction by 27% year on year to 689 billion JPY in FY2014, and in comparison with five years ago, gloss transaction quintupled. Miyamoto, however, revealed that the mobile booking rate dose not reach half yet. Announcing that jalan will start offering local activity booking service in July this year, Miyamoto appealed that it will contribute to revitalization of the travel in Japan market.

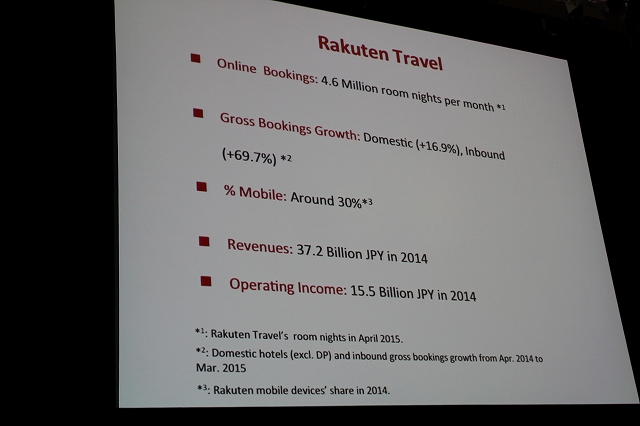

<Rakuten Travel>

Rakuten increased gross bookings in Japan by 16.9% in FY2014 over FY2013, but Yamamoto said that it is possible to increase more as the online market is growing, citing the result of jalan or Ikyu. The growth rate of inbound travel bookings was 69.7%. Yamamoto said of that, “We want to congratulate ourselves after checking the booking.com’s growth rate.”

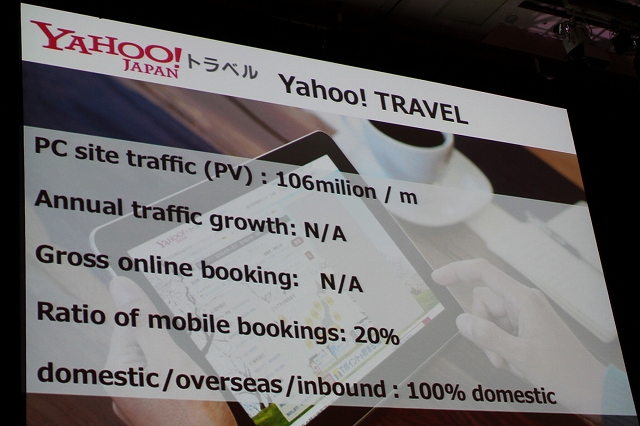

<Yahoo! Japan>

PC site traffic of Yahoo! Japan Travel reached 106 million PV a month, and the ratio of mobile bookings was 20% of the total. Yahoo! Japan Travel deals with travel in Japan only today. However, Yahoo! Japan announced at WIT Japan 2015 that the travel business will begin offering services for inbound travelers to Japan.

<i.JTB>

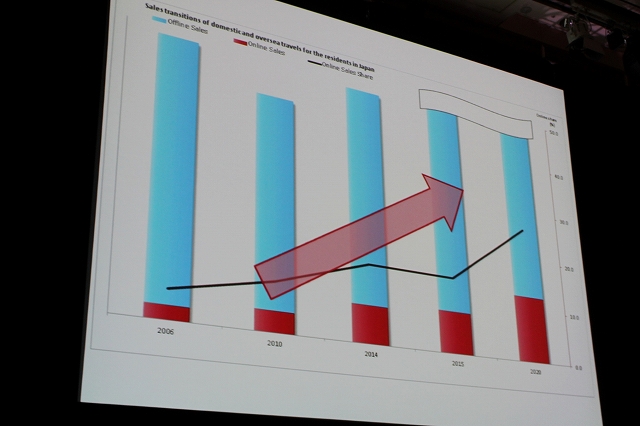

i. JTB CEO Imai said, “Our web business is growing, though it used to be behind major OTAs. Our strength is to have a variety of sales channel.” While travel transactions of entire JTB group were almost unchanged to 1,200 billion yen in FY2014, the online sales ratio rose to around 16% in 2014 from 5 or 6% in 2006. Imai said that online payment has drastically increased for the past two years, expecting the ratio may rise to the level between 28% and 30% in 2020.

<H.I.S.>

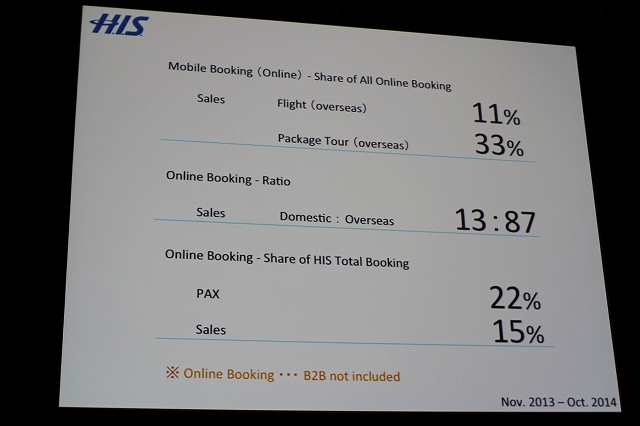

The H.I.S.’s online booking ratio was 22% on a customer basis or 15% on a sales basis in FY2014 (Nov. 2013 to Oct. 2014). Including B to B online bookings, the ratio was up to around 30% on a customer basis or around 21% on a sales basis. The mobile booking ratio (overseas travel) was 11% for flight, while it was 33% for package tour, and Takano said of the trend, “The result was largely affected by TV CM.”

Unlike professional OTAs, both JTB and H.I.S. are trying to combine real booking with online booking by taking advantage of their strengths of the group business. i.JTB CEO Imai said that JTB will accelerate O to O business, showing his ideas that a customer can buy a product at real shop after searching it on internet or a customer can buy a product online after consultation at a real shop.

In Japanese